Request for Free Demo

What is GSTR3B in GST

Date: 2020-10-13

GST law finally came into existence with effect from July 1st, 2017. However, anticipating the lack of IT infrastructure preparedness and to calm the initial taxpayer anxieties, the union finance minister Mr. Arun Jaitley on June 18th, 2017 announced that the GST Return Filing requirements have been relaxed for the first two months. Therefore, through a government notification, GSTR 3B was conceptualized. Further, for ensuring a smooth rollout of the GST taxation system, government of India also extended the filing dates of GSTR 1 and GSTR 2 for the first two months (July and August 2017), below are the notified due dates:

dates:

| For Month | GSTR 3B | GSTR 1 | GSTR 2 | GSTR 3 |

|---|---|---|---|---|

| July, 2017 | Up to 28th Aug | 1st to 5th Sept | 6th to 10th Sept | 11th to 15th Sept |

| (In case ITC is to be claimed) Up to 25th Aug (In case ITC not to be claimed) | ||||

| Aug, 2017 | Up to 20th Sept | 16th to 20th Sept | 21st to 25th Sept | 26th to 30th Sept |

| Sept, 2017 | – N/A – | As prescribed | As prescribed | As prescribed |

Source: http://gsttaxindiagov.in/form-gstr-1-gstr-2-gstr-3-gstr-3b-extension-due-dates-filing-forms/

As per the GST law, a normal taxpayer is required to file GSTR 1, GSTR 2 &GSTR 3 returns for every month. But in case of extension of due dates for GSTR 1 and GSTR 2 for any period, GSTR-3B needs to be filed in lieu of GSTR 3. It is noteworthy that GSTR 3B is neither a replacement nor a substitute for either GSTR 1, GSTR 2 or GSTR 3. It can best be understood as a short-term arrangement to meet the GST compliance requirements. Although, same data filed in GSTR 3B can be used to prepare GSTR 1, but if GSTR 3B is not filed for any such period where it is required, further GST return filings for that period will not be allowed by the GSTN. It is also to be noted that no filing of GSTR 3B will invite interest @18% per annum of amount sought to not paid on due date.

1. Under the normal scenario, GST returns can be filed using any of the following methods:

a. GSTN Common Portal (www.gst.gov.in)

b. Offline utilities provided by GSTN

c. GST Suvidha Providers (GSPs), for example: Masters India

However, taxpayers should be aware that GSTN has not provided any offline utility for the filing of GSTR 3B, i.e. the return must be filed online.

2. Even in scenarios where there is no business transaction during a month, a taxpayer is required to file a Nil Return i.e. taxpayer should submit Nil GSTR 3B return even if there is no business activity during the month of July and August 2017.

3. GSTR 3B must be filed by every registered tax payer (exemptions apply) in lieu of monthly return GSTR 3, whenever notified due to extension of GSTR 1 & GSTR 2.

4. A taxpayer should declare all his outward and inward supply details in GSTR 3B.

5. A taxpayer must file GSTR 3B for every single GSTIN registered under his business organization.

6. After GSTR 3B has been filed, corresponding GSTR 1, GSTR 2 and GSTR 3 also needs to be filed for the same tax period as per the revised deadlines.But a taxpayer cannot file GSTR 1 & GSTR 2 of a month, if he missed filing GSTR 3B of that month.

7. As GSTR 3B is a summary filing of transaction data based on self-assessment, the submitted data will NOT be auto populated for any counter party. Also, no mismatch report can be generated based on such data.

8. There is a provision of late fee of Rs.100/- under CGST and SGST each, if GSTR 3B is filed after the notified due date. However,the maximum late fee amount is Rs.5000/- under each Act.

9. In case of excess ITC claim in GSTR 3B as determined after the filing of corresponding GSTR 2,the excess amount claimed will be reversed from the ITC ledger OR added to the liability ledger.

10. GSTR 3B does not require details to be filed on invoice-level or rate-wise. However, in most cases the taxable value and tax amount must be filed.

11. Although TDS and TCS details are not applicable for the first two months, but the same may be provided if available with the taxpayer.

12. ITC and liability registers will be updated after submission of GSTR 3B.

Pre-conditions

1. A taxpayer should have a valid GSTIN and be registered either as a normal or casual taxpayer.

2. A taxpayer should either have a valid digital signature (DSC) or Aadhaar number, depending upon the filing requirements for his business type.

Log in to your GST Portal using your GSTIN and password – Services Tab – Returns and then click on the Returns Dashboard. Then from the dropdown, select the month as July and click on Monthly Return GSTR 3B [as shown below]

Image Source: www.gst.gov.in

The next page, you see is:

Image Source: www.gst.gov.in

A taxpayer needs to prepare the following information for error-free filing of GSTR 3B return.

Prepare outward supplies & inward supplies liable to reverse charge

The first table i.e. table 3.1 of form GSTR 3B requires a taxpayer to submit all transaction details pertaining to his outward supplies and inward supplies that are liable to reverse charge. In short, table 3.1 of GSTR 3B will be a compilation of all sales invoices issued during a month and those invoices which attract tax liability due to reverse charge.All the five nature of supplies in table 3.1, shown above, are explained below.

3.1 (a) Outward taxable supplies (other than zero rated, nil-rated and exempted):

The dealer is required to provide details of the supplies (in simple words “sales”) details on which tax has been charged in aggregate. He need not segregate rate wise or product wise or bill wise but just put in the consolidated figure [Detail wise data is to be provided in GSTR 1, to be filed by 05/09/2017]. Nutshell, this row will consist data from all outward invoices excluding zero rated, nil-rated, and exempted invoices and will contain details of invoices issued on which GST was charged, irrespective of any payment was received or not.

3.1 (b) Outward taxable supplies (zero rated[1]): All sales to SEZ units and exports are considered as zero-rated.In case taxpayer has engaged himself into exports during the month of July, he is required to provide the details in this column. Here the column IGST has to be filled only if you have exported by taking an option of payment of tax on export and claiming refund later, in case if you have exported without tax then you only need to enter the taxable value.

3.1(c) Other outward supplies (Nil rated, exempted): All invoices which consist of goods or services that attract nil-rate,will be captured in this row. Only total taxable value of invoices is required as there will be no GST tax component.

3.1 (d) Inward supplies (liable to reverse charge): Taxpayers are required to pay GST on Reverse charge basis on certain notified goods and services, purchased from unregistered dealer subject to exemption provided and various services such as GTA, legal service etc., even though this being an expense for the businessmen, the taxpayer is required to pay GST on reverse charge basis and he is also allowed to take Input credit on it. Hence it is advisable to before filing the return to check the Profit & Loss A/c and consult your GST Professional for the advice. This row will capture details of all such inward supply or purchase invoices which are liable for GST taxes on reverse charge basis i.e. the recipient is liable for payment of GST.

3.1 (e) Non-GST outward supplies: This row will contain details of taxable amount for invoices that consists of non-GST goods like crude petroleum, petrol, high speed diesel, natural gas, and aviation turbine fuel.

[1] Deemed Exports- Transactions in which goods supplied do not leave country.

Export without payment of GST – Supply under bond or Letter of Undertaking without payment of IGST.

Export with payment of GST – Any exporter making supplies after paying IGST.

Export to SEZ- Transactions in which supplies are made to SEZ.

** You must ensure to fill in the correct amount of tax collected on the supply in return. **

Prepare supplies to unregistered, composition and UIN dealers

Table 3.2 under form GSTR 3B will capture all data pertaining to inter-state supplies made to unregistered persons, compounding dealers and those with a UIN number. It is important to note that for all intra-state supplies, this table should not be used to capture such data. After filling 3.1, completely click on 3.2 tab only if you have supplied to the following explained taxable persons (The details to be mentioned here should have been already included in 3.1 table, this is just an additional disclosure)

Image Source: www.gst.gov.in

A. Supplies made to Unregistered Persons: This row will capture all inter-state supplies to unregistered customers i.e. consolidated data of all B2C Large invoices.

Logic: In GST, in case if you have done inter-state supply, you would have to pay IGST which the government would have to share with the state where the supply has been consumed (since, GST being a destination based tax) and hence the details of place of Supply has to be provided and details of the total tax of that particular state (again you need not provide bill wise, rate wise and tax wise details).

B. Supplies made to Composition Taxable Persons: This row will contain data from all inter-state invoices issued to Composition dealers.

C. Supplies made to UIN holders: For all inter-state supplies that are made to UIN (GST Unique ID) holders like Consulates, Embassies, and UN Bodies, this row will contain all such data.

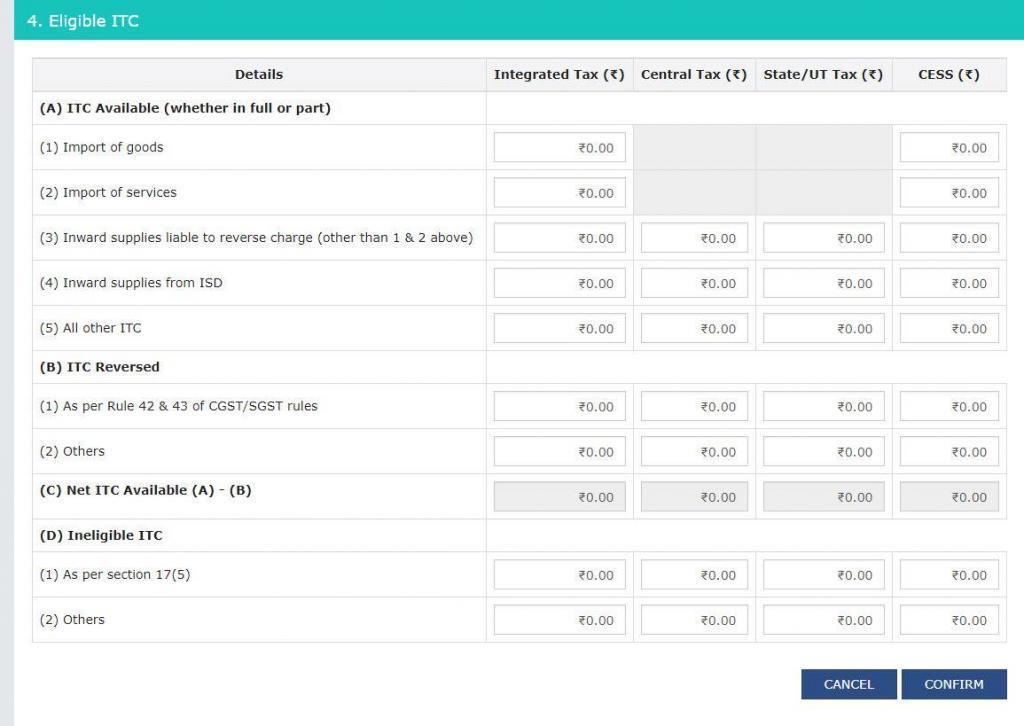

Prepare Details of Input Tax Credit

Table 4 of form GSTR 3B is designed to capture data relating to ITC Available, ITC Reversed and any ITC that is ineligible for claim. This table assumes significance as wrong values submitted here can lead to penalties. In short, a taxpayer must enter accurate purchase invoices data in this table to avail eligible ITC that can be further used for setting off GST liabilities, if any.

Image Source: www.gst.gov.in

4 (A) ITC Available- In this sub table, we are required to fill the details according to fields mentioned therein, the tax amount which is to be taken as INPUT credit.

4 (A)(1) ITC Available from Import of Goods: This row will contain details of all import of goods invoices for which GST along with customs duty was paid.

4 (A)(2)ITC from Import of Services: This row will contain details of all import of goods invoices for which GST was paid.

4 (A)(3)Inward Supplies Liable to Reverse Charge: This row will contain details of all such invoices on which there was tax paid on reverse charge basis.

4 (A)(4)Inward Supplies from ISD: This row is applicable only for those taxpayers who are registered as input service distributors (ISD) and will contain details of ITC claimed for any ISD.

4 (A)(5)All Other Input Tax Credit: This row will contain transaction data from all other invoices except the above, ex: B2B invoices.

4 (B)(1) ITC Reversed: This row will capture data for any ITC that should be reversed incase full ITC was claimed, even when it was eligible for partial claim, as per the ITC reversal laws 42 & 43 under the CGST Act.

4 (B)(2) All Other Input Tax Credit Reversed: This row will capture data for any ITC that should be reversed because of any rule other than the ones above, as per the ITC reversal laws under the GST Act.

4 (C) Net ITC Availed: This row should contain the difference between total ITC available and total ITC reversed.

4 (D) Ineligible ITC

4 (D)(1) As per Section 17(5) – Tax payer will not be eligible to take credit of goods or services acquired which are mentioned in Section 17(5) (Such as motor vehicles, works contract service subject to conditions mentioned therein). Taxpayer is required to mention such details as well for tracking and supervision purposes.

** In the Input Tax credit table, only the value of goods and/or services are NOT to be mentioned but only the tax paid for acquisition of such goods and/or services. **

Prepare Inward Supplies Exempt from GST

Table 5 under form GSTR 3B is designed to capture details of all inward supply invoices that were exempt from GST tax liability.

Image Source: www.gst.gov.in

5 (a) From a supplier under composition scheme, exempt and nil-rated supply: The first row of this table will capture the aggregate value of all inter and intra-state supplies received from a compounding dealer, purchases that are exempted under GST and purchases with nil-GST rate.

5 (b) Non-GST supply: This row will capture details of all non-GST purchase invoices, if any.

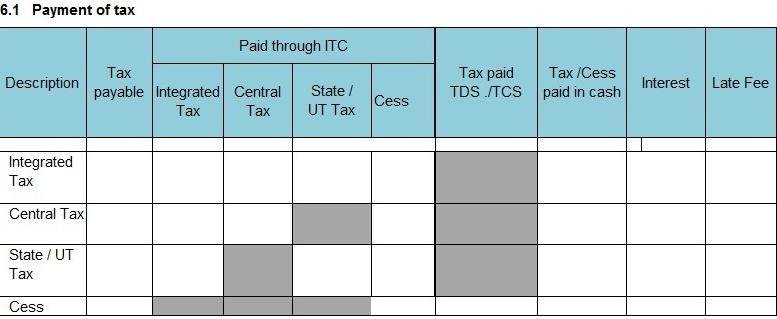

Prepare Details of GST Paid

Table 6.1 under form GSTR 3B is important as it will identify the distribution of how much is the tax liability and how much liability was paid using ITC and cash each.

This table will capture tax payable and paid data for each tax category i.e. IGST, CGST, SGST and CESS. After submission of details of Outward Supplies (Sales) and Inward Supplies (Purchases), tax payable would be auto calculated and you would be required to make the payment of the same.

A. There are two modes to make a payment

Utilizing Input credit paid (As mentioned in Table 4)

Tax/Cess Paid in cash (option of which is available as you log in to GST Portal)

B. The form would not allow cross utilizing of the CGST and SGST.

Image Source: www.gst.gov.in

Prepare Details of TDS and TCS

Table 6.2 under form GSTR 3B will capture data pertaining to any taxes being already paid as part of TDS or TCS deductions. However, currently this form is not available for filing as the government has deferred filing for the same for the initial two months.

Do Composition dealers need to file GSTR 3B:

No, the composition dealers are not required to file GSTR 3B. Composition dealers are required to quarterly file GSTR 4 only.

After filing of GSTR 3B, do my filing obligations finish for July’17:

No, the regular GSTR 1, 2 and 3 would still have be filed by 5th, 10th and 15th September respectively and similarly for August and so on.