Request for Free Demo

What is SAC Code

Date: 2020-10-13

Service accounting code or SAC is a system of classification framed by the Central Board of Indirect Taxes and Customs (CBIC). These codes are used to identify services and GST Rates to compute tax liability.

SAC (Services and Accounting Code) codes depend on the Harmonized System of Nomenclature which is a globally perceived framework for arranging and classifying all the services. This framework empowers the consistence of GST dependent on universal principles. It will give a typical structure to the government for the collection of data or analyzing the equivalent.

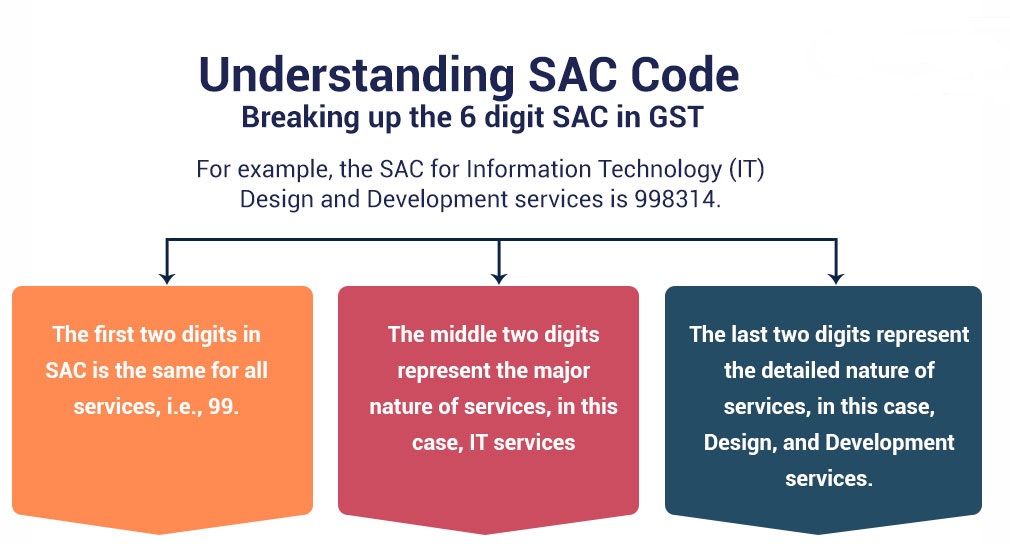

Separating the 6 digit SAC in GST

For instance, the SAC for catering services provided in flights,trains etc.., is 996335.

(i) The initial two digits in SAC is the same for all services, i.e., 99.

(ii) The two digits in between states the significant idea of services(63), for this situation, catering services.

(iii) The last two digits state the nature of services (65), for this situation, catering services provided in flights, trains, and so forth.

Here is the reason why SAC codes are important for the business:

(i) SAC codes help the business and client to distinguish the GST Rates relevant to the particular services.

(ii) SAC code is required to be mentioned at the time of GST Registration

(iii) These codes help to recognize and distinguish the services from the huge number of services available.

The basic difference between the HSN and SAC code is that HSN is used to identify the Goods and SAC codes are used to identify the services. Another contrast between the two is the number of digits present in the code, for instance, HSN code has 8 Digit codes through SAC has 6 digit codes.

The SAC codes and GST rates against the various services give the sellers and business individuals the GST rate applicable to the services they offer or the services they render. So, it is essential to know the SAC codes.

SAC codes must be used by the service providers at the time of filing GST Returns and issuing invoices.

Here are the criteria for utilizing the SAC code in the GSTR filling.

(i) SAC code isn’t compulsory if the organization’s turnover is under 1.5 Crores INR.

(ii) SAC code is compulsory for the business whose turnover is above 1.5 Crore INR.

Chapter 99 of the HSN module is the chapter that is related to services and helps in identifying the different services under SAC code.

SAC codes are utilized to identify various services rendered by business organizations. In case if the turnover of the service provider is more than 1.5 Crores INR, at that point he/she should specify the SAC code in the invoice. What’s more, during GSTR fillings he/she should specify the SAC code for GSTR filling. This does not only saves time for the organization but also helps in keeping a check on the finances.